Does a Living (Revocable) Trust or a Will Protect My Kids Better

By Attorney Patrick Nolan

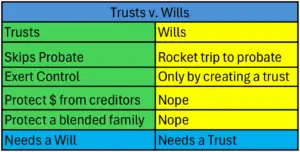

The Verdict: Living Trust vs. Will

The Bottom Line: If you want to keep the government out of your family’s business and ensure your children actually see their inheritance, a Will isn’t enough. You need a Revocable Living Trust.

Here is the breakdown of why the Trust is the superior vehicle for protection.

1. The Probate Trap

The biggest misconception about Wills is that they keep you out of court. They don’t. A Will is simply a letter to a judge telling them how you want your assets distributed after the court takes control of them.

The biggest misconception about Wills is that they keep you out of court. They don’t. A Will is simply a letter to a judge telling them how you want your assets distributed after the court takes control of them.

- The Will: If you rely on a Will, your assets freeze the moment you die. Your family must hire an attorney and endure the probate process, which takes months (or years) and bleeds the estate through court fees.

- The Trust: A Trust bypasses the system entirely. Because you transfer assets into the Trust while you are alive, there is nothing for the court to freeze. Your Successor Trustee steps in immediately, cutting checks and managing assets without asking a judge for permission.

2. Controlling the Money (Rule from the Grave)

Inheritance isn’t just about who gets it; it’s about how they get it. Dumping a lump sum on a grieving 18-year-old is financial negligence.

- Stopping the “Affluenza”: A Trust allows you to stagger distributions. You can give them a third at 25, half at 30, and the rest at 35. It prevents a young heir from blowing the fortune on a Ferrari before they finish college.

- The Divorce Shield: If you leave money outright via a simple Will, your heir might co-mingle the funds with his/her spouse. If your child gets divorced, their ex-spouse could walk away with half your legacy. A Trust keeps the inheritance separate, effectively divorce-proofing the money.

- Creditor Protection: If your child runs into debt or a lawsuit, a properly structured Trust with “spendthrift” provisions locks that money away from creditors.

Can a Will do this? Technically, yes, by creating a “Testamentary Trust.” But remember: to trigger that protection, the Will still has to go through the misery of probate first.

3. The Blended Family Danger Zone

If you are remarried and have children from a prior relationship, a simple Will is a gamble.

- The Risk: If you leave everything to your new spouse, they legally own it. When they die, they can leave your assets to their own kids, a new spouse, or a charity, cutting your biological children out entirely.

- The Trust Solution: A Trust solves this with structure. You can provide for your surviving spouse during their lifetime, but lock the capital so that when they pass, the remaining assets revert strictly to your children. It guarantees your kids aren’t disinherited by a stepparent.

4. The “Living” Part Matters (Incapacity)

You’re probably not dying tomorrow, but a stroke doesn’t send a calendar invite.

- The Will: It does nothing while you are alive. It is a piece of paper that is useless until you are dead.

- The Trust: If you become incapacitated, your Successor Trustee takes over your finances instantly. Without this, your family has to sue you in court for “Conservatorship” just to access your bank accounts to pay your medical bills.

Straight Facts

These documents do different things and neither one is complete without the other – especially if you have kids.

Use a Will for the one thing only a court can do: naming a legal guardian for your minor children.

Use a Living Trust for everything else. It is the only way to ensure private, immediate, and controlled financial protection for your heirs without the state taking a cut.